Know-How to Calculate Monthly Interest Rate with an EMI Calculator

While availing of any loan, the affordability is based on the borrowing cost and the overall payable interest. After availing of credit, individuals are not required to pay the interest component directly. The payment is spread throughout the repayment tenor along with the principal amount in the form of EMIs.

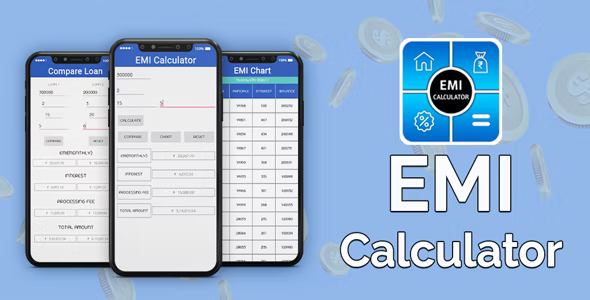

Since EMI comprises both principal and interest components, it is sometimes difficult to estimate the monthly interest. However, they can do the evaluation conveniently either by a mathematical formula or with an .

Know the steps to calculate monthly interest

Before availing of any financial product, estimating the monthly interest component using the formula is essential. However, it is convenient to use an online EMI Calculator. This tool’s user-friendly interface and error-free calculation make it more convenient and reliable for borrowers.

Following are the steps to calculate payable monthly interest against a personal loan.

Step 1: Visit the online portal of any lender and look for a personal loan EMI Calculator

Step 2: Now input loan amount, interest rate, and tenor

Step 3: Lastly, click on “calculate” to complete the process and display the interest amount

With the help of this calculator, individuals can determine EMIs, monthly interest, and overall payable amount within seconds. Borrowers must note that the displayed interest amount is for the entire repayment tenor.

Besides, you can also find an amortization schedule where you can find the entire EMI breakup comprising principal and interest components. It is a matter of fact that the monthly interest changes along with the principal. Usually, during the initial repayment phase, the EMI consists of a substantial interest amount.

Hence one can use a personal loan calculator to view the amortization schedule where individuals can find principal component, monthly payable interest, outstanding balance, repayment tenor, and the percentage of the repaid loan.

Apart from this, one can determine monthly interest and the overall EMI with a single formula-

EMI= P x R x (1+R) ^ N / [(1+R) ^ N-1]

Here P refers to the principal, R denotes the interest rate, and N represents repayment tenor.

However, apart from knowing monthly and overall payable interest, individuals can follow certain tips to avail lowest interest rate on personal loans and ease the repayment burden.

Tips to avail better interest rates

Since personal loans are unsecured credit and come with no-end use restrictions, individuals are not required to go through lengthy documentation, and the amount is disbursed with minimum time. Here are some of the effective tips to secure competitive interest rates on personal loans:

Tip 1: Maintaining a healthy credit score

A borrower with a healthy credit score increases the chances to secure substantial credit with an affordable interest rate. With a higher credit score, individuals can avail themselves of their preferred loan amount at flexible loan terms and additional benefits. However, one must know the ideal CIBIL score for a personal loan before applying to ensure a hassle-free loaning procedure. One can maintain a high credit score by making timely repayments, maintaining a credit utilization ratio, avoiding applying for multiple loans, etc.

Tip 2: Research and compare interest rates

Before applying for any credit, it is wise to research the financial market well and compare the offers extended by the lenders. This can help borrowers secure the best deal, thereby ensuring a great borrowing experience.

Tip 3: Good employment history

Stable employment history will significantly improve borrowers’ personal loan eligibility and help them secure a lower interest rate. But employment in a reputed organization with a stable income source can help achieve favorable loan terms.

Besides, eligible borrowers can also avail of pre-approved offers extended by leading financiers such as Bajaj Finserv. These offers are available in a broader range of financing options such as personal loans, business loans, credit cards, etc. This additional benefit will significantly expedite the loaning procedure and save time. Therefore, individuals can check their pre-approved offers by mentioning their names and contact information.

Hence, besides possessing knowledge about the calculation of monthly interest outgo, individuals must have a well-structured repayment plan before availing of a personal loan or any other credit facility.