The 4 Types Of Life Insurance You Need To Consider

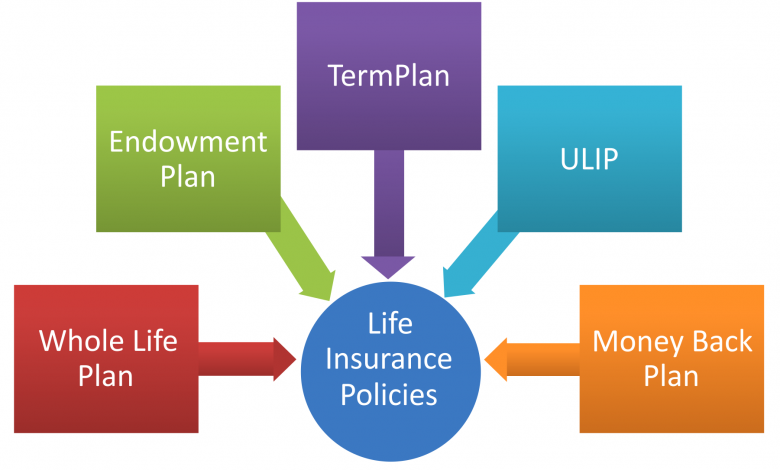

Everyone needs life insurance, and the type of life insurance you need depends on your specific needs and budget. There are four types of life insurance: term, permanent, universal, and variable. Each has its own benefits and drawbacks.

1. Term life insurance

is the cheapest and most common type of life insurance. It pays out a fixed sum of money, typically based on the age of the policyholder when they die.

Permanent life insurance is more expensive than term life insurance but pays out a fixed sum of money regardless of how long you live.

Universal life insurance is the most expensive type of life insurance, but it also offers the widest range of benefits, including coverage for your spouse and children.

Variable life insurance allows you to choose how much money your policy will pay out each year, based on changes in

2: Life insurance for seniors

As more and more people reach the age of 65, the need for life insurance increases. Here are four types of life insurance for seniors you should consider:

1. Universal life insurance provides coverage for a person’s entire lifespan.

2. Term life insurance covers a set period of time, such as 10 or 15 years.

3. Whole life insurance covers your entire financial future, including your retirement savings and your children’s college funds.

4. Variable universal life insurance allows you to choose how much coverage you want, depending on your needs at that moment in time.

3: Universal Life Insurance

Universal life insurance is a type of life insurance that provides coverage for a person and their dependents, regardless of age. Universal life insurance typically has lower premiums than other types of life insurance, but it may not provide enough coverage for some people. Universal life insurance may be a good option for people who do not need comprehensive coverage or who are willing to pay higher premiums. Variable life insurance is a type of life insurance that provides protection against a number of risks, including death, disability, and permanent loss of income. While it is typically more expensive than other types of life insurance, variable life insurance can provide peace

4. Variable Life Insurance

Variable life insurance is a type of life insurance that provides protection against a number of risks, including death, disability, and permanent loss of income. While it is typically more expensive than other types of life insurance, variable life insurance can provide peace of mind in the event of an unexpected tragedy. Thanks to Becky Usanga of HowTosGuru.

Conclusion:

No one policy fits all needs, so you need to consider the pros and cons of each type of life insurance before making a decision.