How Credit Card Processing Works?

When you swipe your credit card through a credit card processing machine, the machine reads the information encoded in the magnetic strip on the back of your card. This information includes your name, account number, and other important details. The machine sends this data to the credit card company, which verifies that it is legitimate and approves the transaction. The credit card company then sends the information to the bank that issued your credit card. The bank authorizes the transaction and records it in your account.

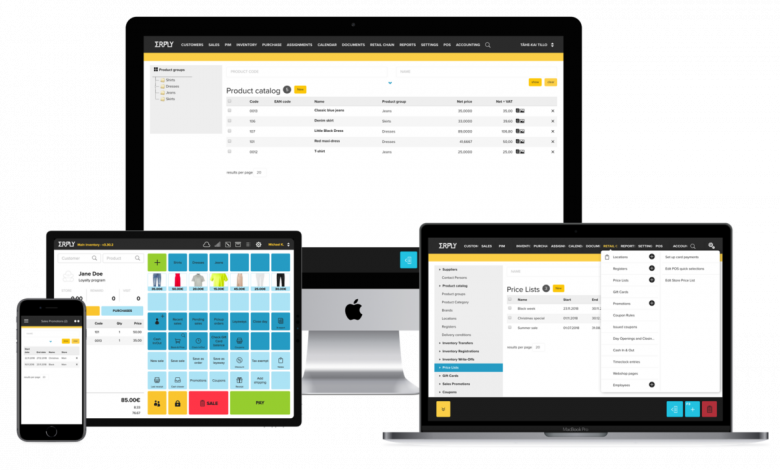

Credit card processing machines are either standalone devices or part of a point-of-sale (POS) system. A standalone machine is a self-contained unit that includes a keypad, LCD screen, and card reader. A POS system is a more sophisticated device that includes a computer, monitor, and printer. In addition to processing credit cards, POS systems can also be used to track sales, manage inventory, and create customer profiles.

There are several different types of credit card processing machines, but the most common type is the countertop machine. This type of machine is typically used by small businesses and can be attached to a POS system or operated as a standalone device. Countertop machines are small and lightweight, making them easy to move around. They also have an LCD screen that allows you to view the details of each transaction.

Another common type of credit card processing machine is the mobile processing device. These devices come in several forms, including tablets and mobile phones. Using a card reader attachment or Bluetooth connection, mobile processing devices allow you to swipe cards directly on your smartphone or tablet. They are quick and easy to use, which makes them ideal for brick-and-mortar businesses that operate at different locations or that need to swipe cards on the go.

Before a credit card processing machine can be used, it must be properly set up and configured to process transactions. The first step is to connect the machine to a phone line or wireless router, which allows it to connect to a credit card company’s network. You also need to enter your merchant account information into the machine. This includes your bank routing number and checking account information, as well as your credit card company username and password. If you use a standalone machine, make sure to enter your sales taxes and security codes for each type of card you accept.

Once the machine is online and configured for processing, it’s ready to be used! Every time you swipe a credit card, the machine will send the information to the credit card company for verification. If the transaction is approved, the credit card company will send a message back to the machine indicating that the sale has been completed. The machine will then print out a receipt for the customer and record the sale in its internal memory.Credit card processing is a quick and easy way to accept payments for your business. By using a credit card processing machine, you can streamline your sales process and improve customer satisfaction. When choosing a credit card processing machine, be sure to select one that is suitable for your business needs. There are many different types of machines available, so choose the one that best meets your needs and budget